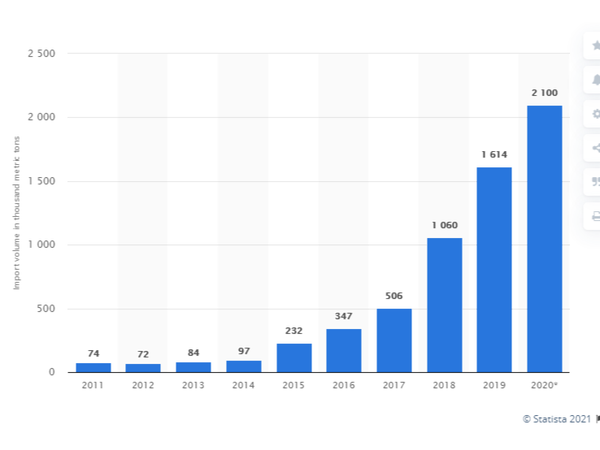

While Japanese biomass demand continued strong growth in 2020, upcoming policy changes will impact trade flows, supply, and demand. Hawkins Wright estimates Japanese wood pellet demand was 1.8 million metric tons (MT) in 2020, up 20% on the year with little sign of slowing. We forecast wood pellet demand will grow 33% in 2021. Japan’s Ministry of Economy, Trade, and Industry have approved nearly 8 GW of woody biomass capacity under the feed-in-tariff (FiT), but many projects are not at an advanced development stage. Not all the 70-plus projects we have identified are expected to make it online, but approximately half are already under construction or finance.

|

Source from https://www.statista.com/

Introduction of Sustainability Criteria

Potential changes to sustainability criteria in Japan could have a significant impact on available palm kernel shell (PSK) supply. METI is considering introducing new criteria for agricultural byproducts, including PKS, and is examining the lifecycle greenhouse gas (GHG) emissions of wood pellets and wood chips. Under the current FiT rules, biomass power project developers are required to provide evidence in their business plans that their feedstocks will be sustainably sourced, legal and traceable. There is no legal requirement, at present, mandating the use of Forest Stewardship Council or Programme for the Endorsement of Forest Certification-certified wood, but there is a general acceptance—endorsed by lenders—that imported wood pellets should have chain-of-custody systems in place.

METI established a biomass sustainability working group to examine the technical aspects of sustainability for agricultural products. It has proposed criteria and recommended which certification schemes meet the requirements.

With regard to PKS, METI's latest guidelines, if adopted, could have a substantial effect on PKS availability. There is very limited uptake of sustainability certification for palm oil plantations in Indonesia and Malaysia; thus, sourcing acceptable PKS could become challenging and costly. In addition, the COVID-19 pandemic has significantly slowed progress in obtaining sustainability certification in Malaysia and Indonesia.

A limited quantity of certified PKS supply could push end-users to look for alternative biomass sources and may drive demand for wood pellets. However, some end users who had planned to rely solely on PKS do not have the infrastructure and equipment, such as covered storage spaces, to handle white wood pellets. Therefore, there may be an opportunity for other biomass that can be stored in a similar manner to PKS, such as wood chips and black wood pellets.

The same working group began to examine the lifecycle GHG emissions of wood pellets and wood chips in 2020. It is investigating whether existing sustainability certification schemes such as the Sustainable Biomass Partnership could be used to prove compliance with any standards introduced. We expect more detailed information on the issue early this year.

Original post by By Rachel Levinson @http://biomassmagazine.com/